Continuity Web

Getting Started

Episodics

Adding Episodes

Viewing Multiple Episodes

Episodics: Traditional vs. Like a Feature

Season Data Transfer

Logging In With Your EP Account

Register for SyncOnSet

Creating a Production and Initial Script Breakdown

Revising a Script

Ensuring Script Breakdown Accuracy

Accessing My Productions

Production Homepage Overview

Production Security

Managing Users and Permissions

Working on a Shared Breakdown

Multi-Department Views

Free Trials

Lite Plan for Features

Student Productions

Universal Search

Adding Notes

Managing Approvals

Calendar View

SyncOnSet Best Practices for COVID Compliance

The New and Improved SyncOnSet

Scenes

Scene Index Overview

Customizing the Scene Index

Managing Scenes

Managing Script Locations

Adding and Updating Shoot Dates

Scene View Overview

Adding Characters to a Scene

Inventory

Inventory Overview

Managing Inventory

Customizing the Inventory Index

Character Closets

Adding and Deleting Inventory

Inventory Reports

The New and Improved Inventory

Tracking Assets in Continuity

Characters and Sets

Character Index Overview

Character View Overview

Principal Characters with Multiple Numbers

Adding and Removing Background

Adding and Removing Principal Characters

Linking and Merging Characters

Deleting a Character

Set Index Overview

Set View Overview

Adding and Removing Sets

Changes and Looks

The New and Improved Changes and Looks

Changes Overview

Building a Change

Adding and Removing Changes

Editing and Inserting Changes

Bag Tags/Change Labels

Looks Overview

Building Looks for HMU

Adding and Removing Looks

Actors

Actor Index Overview

Creating Actors and Assigning Actors to Characters

Actor View Overview

The New and Improved Actors

Gallery

Gallery Overview

Uploading and Tagging Photos

Sorting and Filtering the Gallery

Printing & Sharing Photos

Wrap, Continuity Book, and Reports

Continuity Mobile

Getting Started

[Mobile] Logging In With Your EP Account

What's New in 5.5.0?

[Mobile] Home Page

[Mobile] App Settings

[Mobile] Multi-Department View

[Mobile] Syncing

[Mobile] Universal Search

[Mobile] Switching Productions and Multi-Episode View

[Mobile] Adding Notes

[Mobile] Permissions

The New and Improved Mobile App

Mobile App Overview

[Mobile] Upgrading to SyncOnSet 5.0

Scenes

Inventory

[Mobile] Inventory Overview

[Mobile] Character Closets

[Mobile] The New and Improved Inventory

[Mobile] Managing Inventory

[Mobile] Adding and Removing Inventory

Characters + Sets

[Mobile] Character Index Overview

[Mobile] Character View Overview

[Mobile] Viewing Characters by Scene

[Mobile] Sets Overview

[Mobile] Viewing Sets by Scene

Changes & Looks

[Mobile] Adding and Removing Changes

[Mobile] Building A Change

[Mobile] Printing Bag Tags

[Mobile] Adding and Removing Looks

[Mobile] Building Looks for HMU

The New and Improved Changes and Looks for Mobile

Wrap

Actors

Photos

Budgeting and Money Tracking

Budgeting

Budget Overview

Creating an Amort Episode

Budgeting for Costume

Budgeting for Miscellaneous

Budgeting for Props

Budgeting for Set Dec

Budget and Money Tracking Best Practices

Budget Reports

Money Tracking

FAQs

Troubleshooting Guides

Cannot Edit Production

Scenes/Characters Missing After Breakdown

Unable to Sync

Missing Photos

Miscellaneous Groups Don’t Match

Bag Tag Printing Skips Labels

Reports Skipping Pages

Editing the Name of a Script Revision

Web Browser is Slow

Product Updates

AssetHub

Getting Started

Managing Assets

Creating Assets

Creating Assets by Exporting Inventory from SyncOnSet

Creating Assets Manually

Creating Assets with Asset Import

Reconciling Single Transactions as Assets

Reconciling Journal Entries

Handling Returns

Bulk Reconciling Transactions

Bulk Updating

Excluding Transactions

Splitting Transactions

Splitting/Duplicating Assets

Merging Assets

Adding Photos to an Asset

Uploading Documents to an Asset

Choosing the Correct Disposition

Creating Storage Locations and Sub Locations

Additional Features

Running Reports (Asset Pages, CSV, PDF, Asset Disposition Report)

Searching and Filtering Assets

Creating, Editing, and Deleting Characters and Sets

Moving Assets Within AssetHub

Managing Groups

Trashing Assets

Requests and Approvals

Accessing AssetHub on a Mobile Device

Using Barcodes with Assets

AssetHub Best Practices for COVID Compliance

Features and Series

Accounting

Accounting Onboarding

Locking Currencies

Exporting Asset Reports from SmartAccounting

Exporting Asset Reports from Global Vista

Exporting Asset Reports from PSL

Uploading Ledgers

Matching Columns

Handling POs

Production Coordinator

Crew

Adding Project Users and Managing Permissions

User Permission Levels

Studios and Divisions

Creating Division Assets

Managing Events

Adding Studio Users and Managing Permissions

Customizing Fields Within Departments

Troubleshooting Guides

Webinars

All SyncOnSet Webinars

Introduction to SyncOnSet Continuity Web: Script Breakdown, Revisions, Linking and Deleting Characters

SyncOnSet Continuity Web for Costume

SyncOnSet Budgeting for Costume

Advanced SyncOnSet: Best Practices & Pro Tips

SyncOnSet for Production Coordinators

SyncOnSet Continuity for Episodic Teams: Block Shooting & Cross-boarding, Characters, Actors, and Inventory

SyncOnSet 5.0 Mobile App: Navigation, Uploading and Tagging Photos

SyncOnSet Continuity Hair & Makeup

SyncOnSet Continuity for Set Dec: Using the Mobile App

Budgeting & Money Tracking for Costumes

Budgeting & Money Tracking for Set Dec

SyncOnSet for Episodics: Season Data Transfer

SyncOnSet for Props: Introduction to Continuity & Budgeting (Web)

Transitioning to SyncOnSet 5.0 Mobile

SyncOnSet for Costumes: Adding Inventory, Changes, and Photos in Continuity Web

SyncOnSet for Students: Intro to Continuity Web

SyncOnSet Continuity Web: Production-Wide Account Basics

All AssetHub Webinars

Introduction to AssetHub 4.0: Demo

AssetHub: Managing Permissions & Adding Team Members

AssetHub: Managing Journal Entries, Returns, Merging, and Bulk Updating

Exporting Inventory from SyncOnSet to AssetHub

Webinars for Costume

Webinars for Hair and Makeup

Webinars for Props

Webinars for Set Dec

Table of Contents

- All Categories

- Budgeting and Money Tracking

- Money Tracking

- Adding and Updating Payments

Adding and Updating Payments

Adding and Updating Payments is only available to the Costume and Set Dec departments.

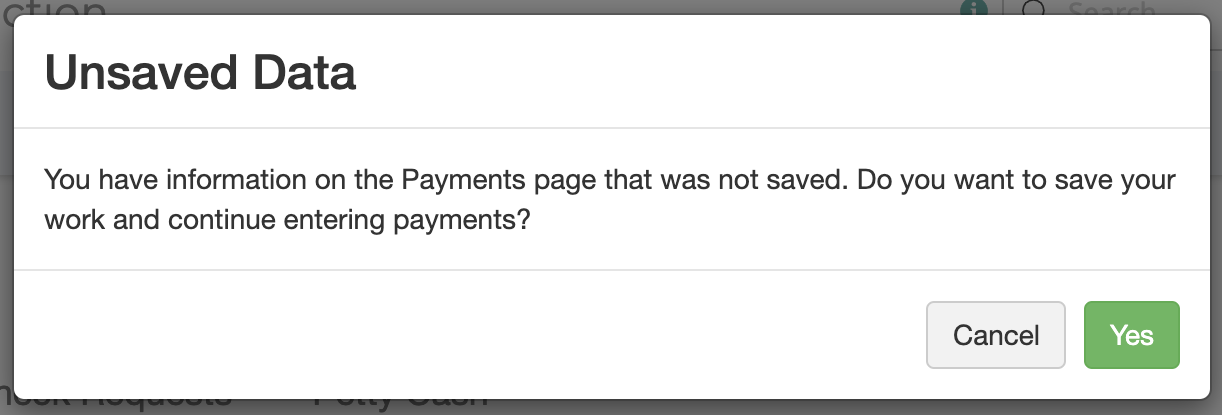

Once you’ve finished your Budget, you’re ready to start adding and tracking Payments!

To get to the Payments page, use the Product Switcher in the top left hand corner and click Budgeting. From the Budget, click Payments in the top navigation bar.

Adding Payments

The Payments page shows you all of your Payments by default.

To create Payments, click into one of the four Payment types:

- Purchase Order: A document sent from a purchaser to a vendor that authorizes a purchase.

- P-Card: Short for Purchasing Card. A card or account number that employees can use to make purchases or payments on behalf of their employer.

- Check Request: Forms that are used to request payment when an invoice is not available or was not provided.

- Petty Cash: A small amount of cash used to pay small expenses without writing a check.

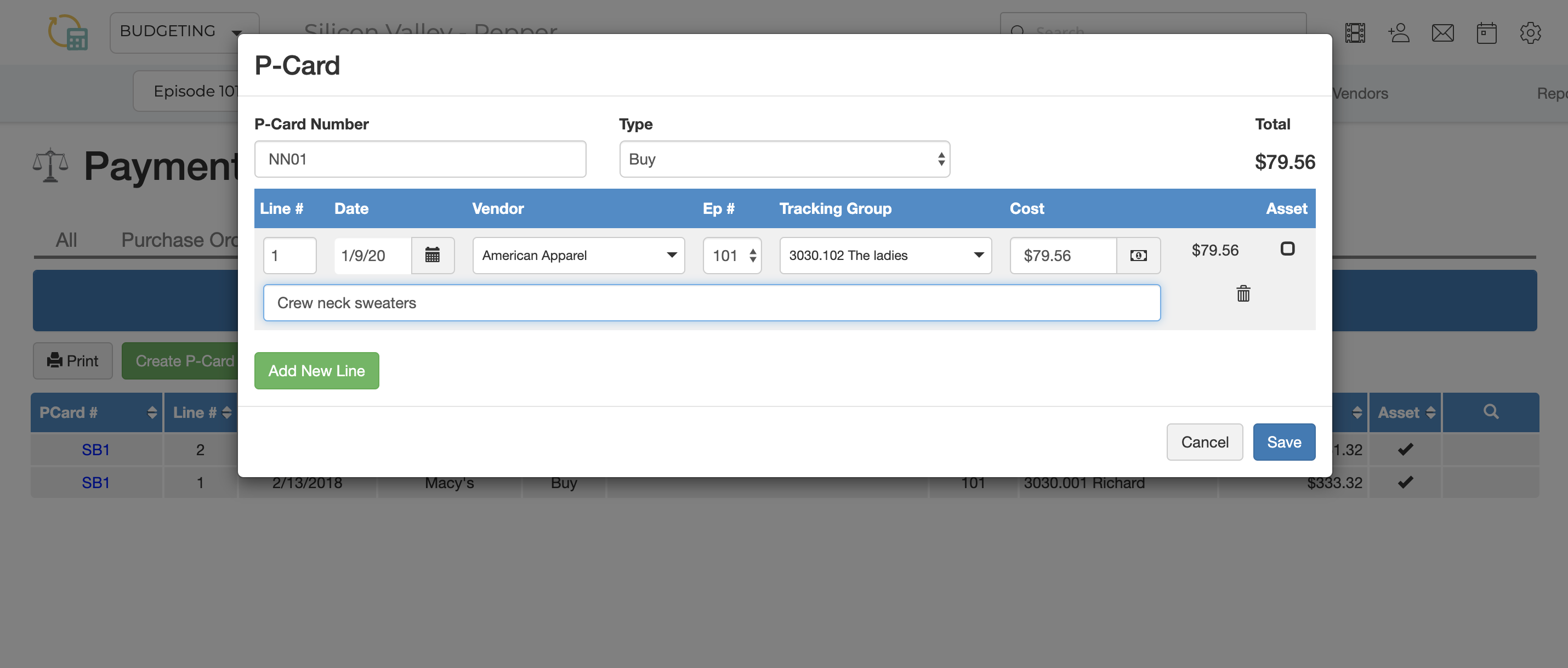

For this article, we’ll use a P-card.

- Click Create P-Card Envelope.

- In the Create Payment form, enter all of the Payment information.

- If you want to add more lines to this envelope, click Add New Line.

- Click Save. You can always click on the envelope at a later time to add more payments.

Adding Tax and Shipping Costs

You can add tax or shipping costs separately from the item cost.

- Click the Dollar icon next to the cost.

- Add tax in the Tax area:

- Enter the tax rate in the area on the left and have the system automatically calculate the total tax (example: if the tax rate is 9.5% enter .095) or

- Enter the total tax paid on the item on the right.

- Enter the shipping cost in the Shipping area.

- Click Done.

- The total cost of the item now includes the tax and/or shipping costs.

Updating Payments

Payments can be edited, deleted, or marked as “returned” from the Payments page of Money Tracking. Payments can also be designated as Assets if you wish to track your production's Assets.

To edit a Payment, go to the Payments Index:

- Use the Magnifying Glass icon in the table header to quickly search for a specific Payment.

- Click anywhere on the Payment line you would like to update.

- Make your changes.

- Click the green Checkmark button to save.

- To delete a Payment, click the red Trash Can button.

Payments can also be edited from an Edit form:

- Click a blue link in the Payment # column.

- Make updates and/or click Add New Line to add a new line to an existing Payment.

- Click Save.

Check out Managing Returns to learn how to mark your Payments as returns.

Filtering and Sorting Payments

Filter and sort Payments to refine your view.

Filtering Payments

Filter by any column on the Payment Index - or filter by multiple columns. When filtering Payments, the running total at the top of the page will reflect your filter(s).

- Click Payments in the top navigation bar.

- Click the Magnifying Glass icon in the table header to open search fields.

- Use the search fields to refine your Payments. Filters update in real time.

Sorting Payments

Sort Payments by column by clicking on a column header.

Related Article: Managing Returns